How Tampa homebuilders are luring consumers again

[ad_1]

More homebuilders are offering mortgage buydowns to get potential buyers to the closing table, Axios’ James Briggs reports.

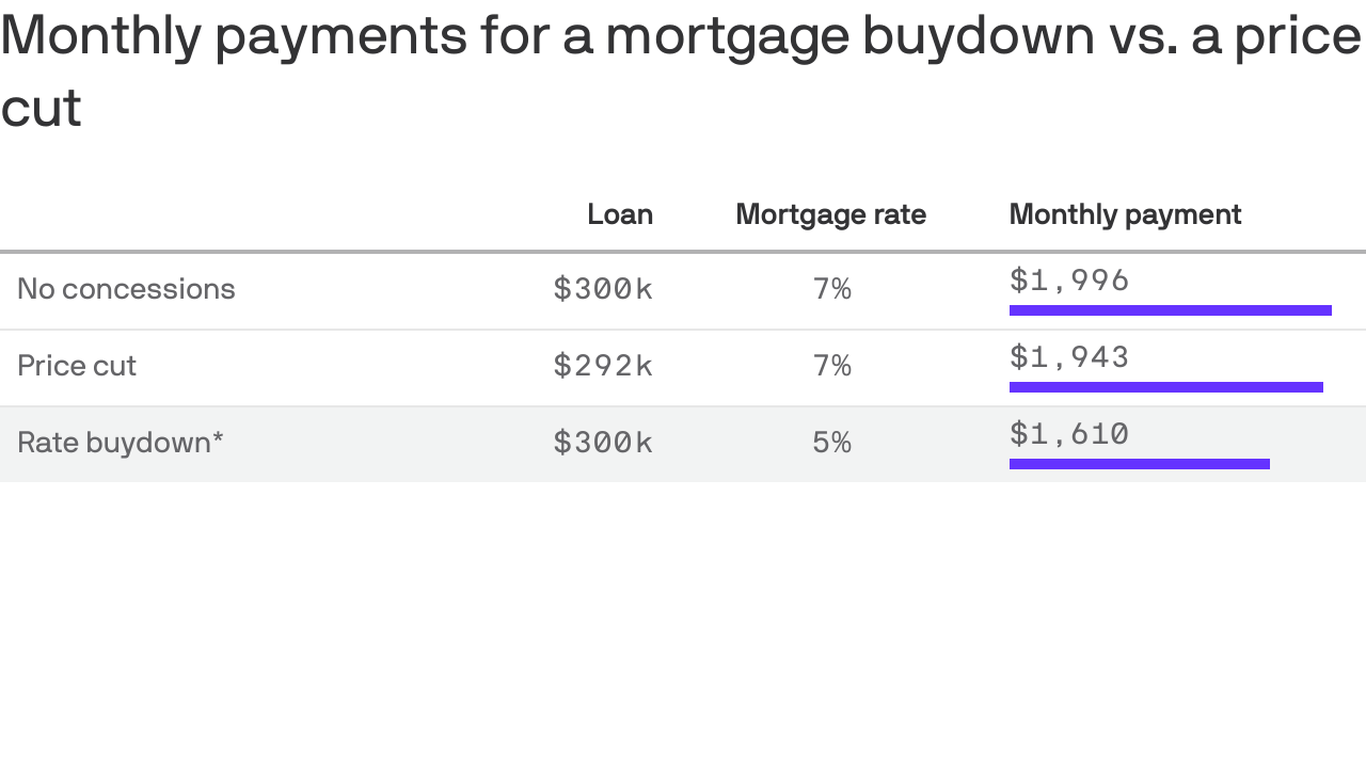

Context: A buydown is when sellers, homebuilders or even lenders pay cash to lower the buyer’s mortgage rate by typically one to three points, Axios’ Emily Peck explains.

- The cash goes directly to the mortgage lender during the closing process, Brian Bullock, VP of sales and marketing for Homes By WestBay, tells Axios.

- If you’re working with a builder, they may require you to work with their preferred lender, he notes.

Why it matters: Buyers have a shot at more affordable monthly payments.

Of note: Buydowns are nothing new for homebuilders, which have had this tool in their box “forever,” as Peck writes. But it’s a tool most builders are reaching for today.

How it works: Builders pay money up front to cut the price of a mortgage for a period as short as two years or as long as 30 years.

Zoom in: Bullock says Tampa Bay-area buyers are using buydowns in a couple of different ways.

First-time buyers and those limited by affordability are more attracted to long-term buydowns, which can last for the life of their loan.

- Lenders use that lower rate to determine how much house the buyer can afford. This helps buyers increase their purchasing power, Bullock explains.

- Bullock predicts this type of buydown incentive will continue to be really popular, and necessary, to make purchasing a home affordable for entry-level buyers.

Current homeowners or those who are more financially secure don’t need to be locked into a lower payment to get into a home. They use short-term buydowns to save a little cash in the first couple years of their loan.

- Short-term buydowns were hugely popular last year when rates topped 7%, he says.

- As mortgage rates decline, short-term incentives have become less popular, Bullock says.

Zoom out: About 75% of builders are dangling mortgage rates that buyers can’t find on their own through lending institutions, according to surveys conducted by John Burns Real Estate Consulting.

- 32% of builders are offering buydowns for the entire length of the mortgage.

- 30% offer reduced rates for the first two years of a mortgage.

Bottom line: Buydowns can save buyers some cash.

[ad_2]